See how your digital experience stacks up.

Download the 2023 Financial Services Digital Experience Benchmark report.

What sets apart the leaders in digital banking? How do they manage to stand out and consistently attract new customers? And perhaps most importantly, how do they navigate the complex web of varying needs and desires of millions of individuals?

Uncovering the secrets behind their success is a fascinating journey that requires a deep dive into their customer-centric strategies, innovative technologies, and ability to adapt to evolving trends. In this article, we unravel the digital banking strategy and strategies but also tactics employed by digital banking leaders, shedding light on the path to digital banking excellence.

In their digital banking strategy, leaders prioritize meeting their customers’ expectations by offering seamless and reliable digital services. They understand that customers increasingly prefer digital channels for everyday transactions and, only if necessary, ask for a professional to help them for the most important ones.

In fact, banks themselves are inclined towards digital services because of an additional reason: the significant cost advantage it provides. The cost per transaction in digital banking can be as low as 0.1 USD, compared to the lower-end cost of 6 USD for servicing through contact centers.

So it happens that the preferred method for interacting with a bank for most common transactions is the most cost-effective as well.

Keeping these factors in mind, digital banking leaders focus on enhancing self-service capabilities for low-touch transactions. They ensure that these services are delivered at scale and consistently, recognizing that nothing is more frustrating for a customer than encountering a flawed or subpar experience. Studies indicate that when customers are compelled to shift from digital to human service, their Net Promoter Score (NPS) drops by a staggering 36 points.

To avoid disappointing customers, it is crucial to offer the experience they desire and never fall short. Building trust and meeting customer expectations should be a top priority in the digital banking landscape.

According to The Digital Banking Report, a whopping 64% of bankers strongly believe that mobile banking is the best alternative to traditional bank branches. In today’s digital era, it’s no surprise that mobile devices have become the primary way we access the online world. In the United States alone, a staggering 220 million users regularly use mobile banking, and 4 out of 10 people cite it as a major reason for switching banks.

In their Digital banking strategy, leaders understand these changing customer preferences and work hard to give customers the freedom to do what they need through digital channels. They recognize that in our fast-paced world, banking should fit seamlessly into our busy lives. Mobile banking takes the lead by offering unmatched convenience, allowing customers to handle their finances whenever and wherever they want.

Imagine being able to check your account balance while enjoying your morning coffee at a local café. Think about how convenient it would be to transfer money to a friend during your lunch break, without the need to visit a physical bank branch. Mobile banking liberates customers from the limitations of traditional banking hours and locations. It empowers individuals to be in control of their finances on their own terms, without being tied down to physical branches.

By prioritizing excellence in app experience and innovation, banks aim to secure a competitive edge in the dynamic world of digital banking and make sure that they offer the experience their customers are demanding, and retain them.

See how your digital experience stacks up. Download the 2023 Financial Services Digital Experience Benchmark report.

Digital banking leaders have a deep understanding of their customers and their preferences. They go beyond simply listening to what customers say, recognizing that a significant portion of customer experience lies in their actions and behavior between clicks. By closely observing and analyzing user behavior, these leaders gain valuable insights into what truly matters to customers.

These leaders grasp the importance of making an impact at scale. Every decision they make is guided by the goal of maximizing benefits for the majority of their customer base. They meticulously measure the effects of introducing new features or resolving issues to ensure they consistently build a narrative of success. Understanding how each change impacts users allows them to refine their offerings and deliver the most value. And they do it fast and consistently.

Maintaining a long-term mindset is crucial in the ever-evolving digital landscape. Digital experiences are an ongoing process, as customers evolve, learn, and adapt their behaviors. These leaders embrace the philosophy of continuous improvement, constantly learning and iterating at a rapid pace. Armed with behavioral data, they have the confidence to understand their customers deeply and quantitatively measure the value they deliver.

By listening attentively to customers, focusing on impact at scale, and embracing an iterative approach, digital banking leaders navigate the complexities of customer expectations and maintain a competitive edge in the dynamic realm of digital banking. Their commitment to understanding and delivering what customers truly want ensures their sustained success in the ever-changing digital landscape.

Contentsquare can help you put your customer experience at the center of your decision making at scale. You can quickly understand what’s frustrating your customers and find the context and detail you need for faster resolution and digital banking iteration.

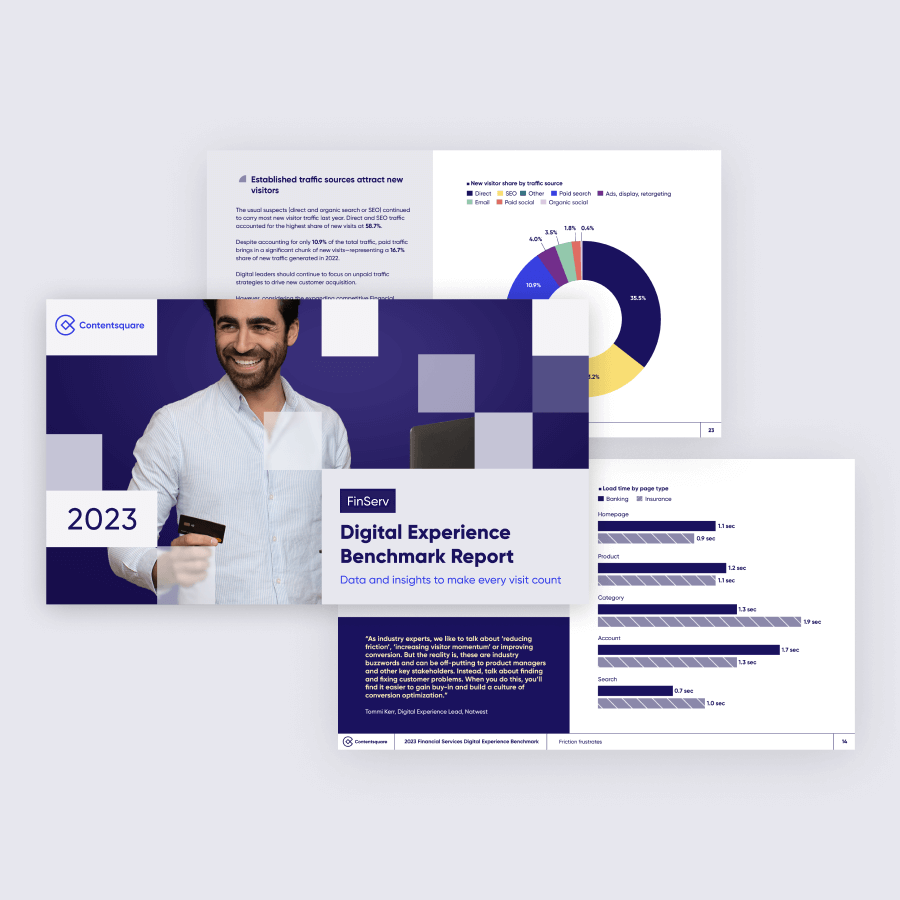

As per our FSI Digital Experience Benchmark report, we can suggest to focus on some key points:

Would you like to know more? Check out our demo or ask for more information.

Take a product tour Get to grips with Contentsquare fundamentals with this 6 minute product tour.